How will ETH Merge affect the DeFi ecosystem?

Published On : Oct 27, 2022

The Ethereum network upgraded to the Merge, shifting from Proof of Work to Proof of Stake. This eliminated miners and reduced power consumption by over 99%, while validators now receive rewards and can upgrade the DeFi and Web 3.0 ecosystem, making transactions faster, smoother, and more efficient.

Ethereum, the world’s largest programmable blockchain and 2nd largest crypto project just after BTC, is the foundation for the future of the Internet (Web3) and the future of finance, i.e., Decentralized Finance (DeFi). Despite the market volatility and macroeconomic uncertainty since its genesis, Ethereum’s founder Vitalik Buterin was always looking for growth as he focused on the long-term building of the ETH network.

For this reason, the Merge of the ETH network was executed last month. This Merge will eventually open the doors for the DeFi to the world.

Before understanding the effects of the Merge on DeFi, let’s first look at the working of ETH and the change in the ETH network after the Merge.

Changes in the ETH network

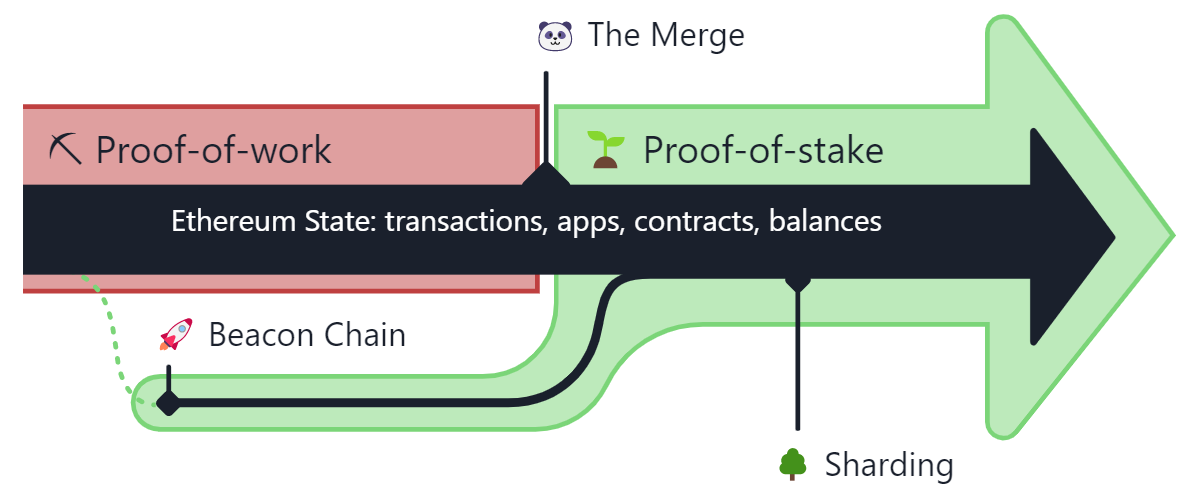

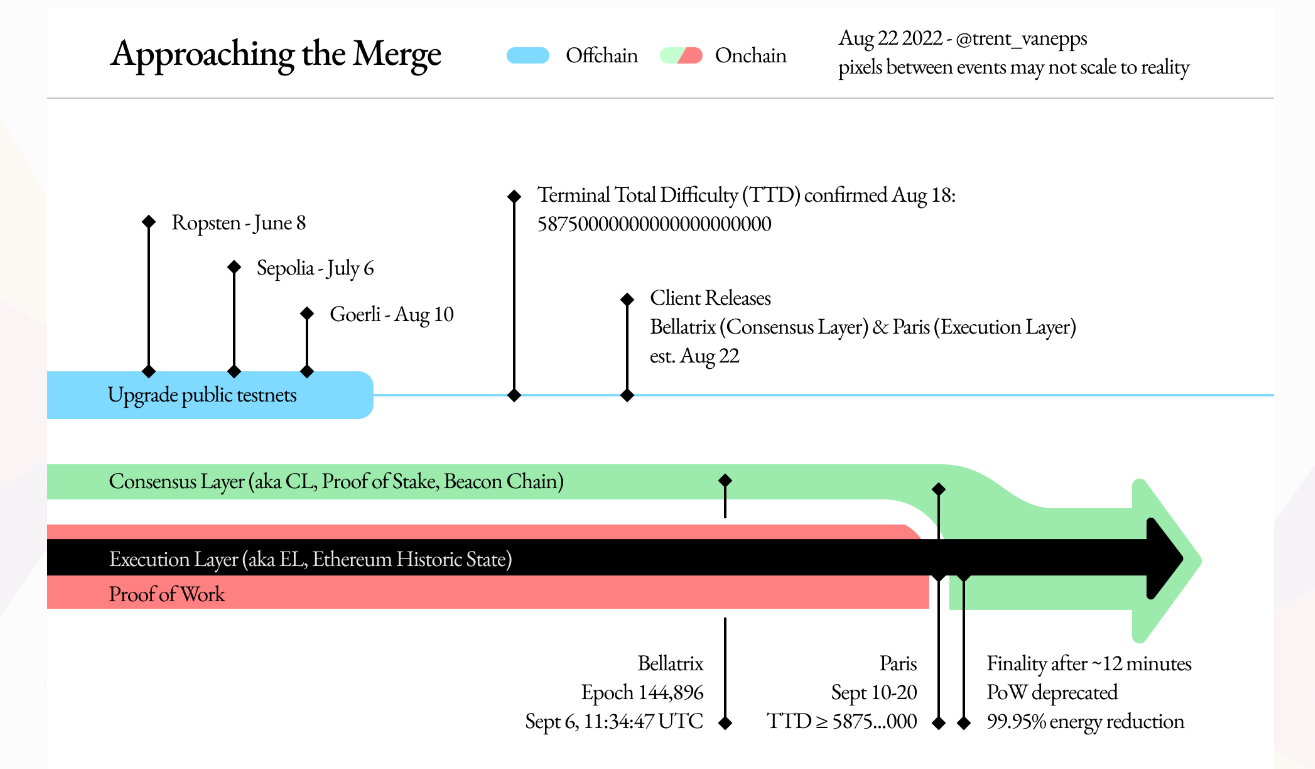

Ethereum has been working on Proof of Work since its inception in July 2015. However, on December 1, 2020, a new, separate consensus Proof-of-Stake layer called Beacon Chain was created from the existing mainnet.

The Ethereum mainnet usually runs for all accounts and applications and in parallel with the PoW with the Beacon layer following PoS. Therefore, the Beacon chain worked side-by-side with testing and processing with active validators without impacting the PoW mainnet.

After a successful check, the Merge took place on September 15, 2022.

As a result, the beacon chain running in PoS has become a run-level consensus mechanism as a single chain handling all accounts, user data, and transactions.

The Ethereum Merge refers to merging Ethereum’s mainnet (the execution layer currently protected by the energy-intensive Proof-of-Work system) and another consensus layer, the Beacon Chain, based on the Proof-of-Stake mechanism. Once complete, transaction blocks are added to the Ethereum blockchain via proof-of-stake verification only, eliminating the role of Ethereum miners and their heavy carbon footprint.

Currently, in the move to Proof of Stake, validators are in charge of the verification process without the need to mine blocks and verify blocks, which consumes high computational power.

As Ethereum moves to Proof of Stake, it will use tokens to rely on validators to validate transactions and add new blocks to the chain. Ethereum stakers must deposit 32 ETH on the beacon chain, also known as the consensus layer, to run validator nodes. Alternatively, you can deposit a small amount of ETH into a staking pool.

Now, let us look at the effects of the Merge on DeFi.

DeFi market after Merge

Over the past two years, ETH network adoption and usage have skyrocketed, sending a strong signal of network maturity. Today, over half of the entire DeFi ecosystem run, works, and builds on the Ethereum network. For example, AAVE and Uniswap are the two largest DeFi platforms built on Ethereum. Since the ETH network moved from POW to POS, it will lead to some significant technological upgrades in the DeFi and Web 3.0 ecosystem seen in recent history. This upgrade not only benefits the environment but also network adoption and growth. Businesses can build more easily and confidently on the Ethereum network without worrying about power consumption or sustainability regulations. The transaction will be smooth and fast as compared to before. More dApps can be built easily and efficiently. You may have seen it widely covered by all Web 3.0 publications, projects, influencers, and traditional media sources on the Internet.

DeFi market after Merge

The changes can be seen in the ETH network system. The ETH network formally abandoned the energy-intensive miner-based system, which was previously used to handle distributed ledger updates. By removing compute-intensive proof-of-work mining from Ethereum, the Merge helps reduce the overall network power consumption by more than 99%.

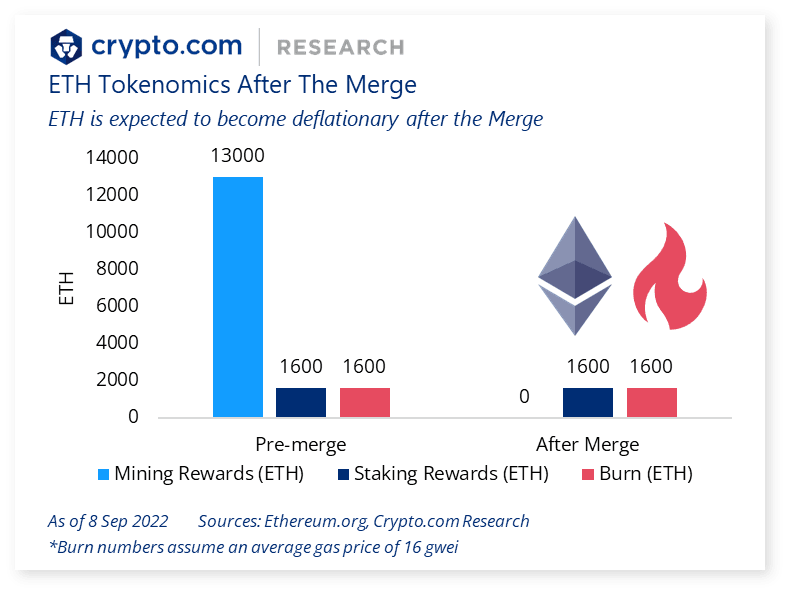

By moving from Proof of Work (PoW) to Proof of Stake (PoS) consensus mechanisms, the Merge will change how value is accumulated across the Ethereum network. Validators are rewarded 5.5–13.2% for validating transactions and adding them to blocks, while token holders are rewarded through the token-burning mechanism.

This Merge will further deflate Ethereum supply as it will be issued less. Currently, ETH is issued at the execution level as a reward to miners and at the consensus level as a reward to validators. After the integration, issuance will stop at the run level, reducing new ETH issuance by almost 90%.

Let us understand how the move from PoW to PoS will affect the ETH issuance rate.

Before the Merge, Ethereum PoW and Ethereum PoS were working in parallel. So there were two sources of miner rewards on the Ethereum PoW chain and validator rewards on the Ethereum PoS chain. After the merge, only Ethereum PoS will work, and there will be no more miner rewards. So, the validator rewards will remain Ethereum’s only issuance source. In addition, let us not forget about the burning mechanism of ETH. Of course, this will not happen immediately. However, with time when the ETH network will be more in usage and more transactions will be done on the network, we will definitely see a deflationary rate of issuance.

Now, the Ethereum transactions are not validated by miners doing the math but by validators who stake their own money (in the form of ETH) as collateral to ensure they are diligent and honest in their validation. In return, validators who successfully add blocks to the blockchain receive a monetary reward for their work. In the context of Ethereum, the validator would have to stake 32 ETH (at the current price of 1558$, as marked on 27th Oct 2022, it is around $50,000) to run a validator node.

This new system, therefore, creates the potential to generate direct and secure income from ETH holdings. This is a great deal for investors, especially in the DeFi world, and could prove attractive to money managers whose primary concern is to generate stable returns with high upside potential.

Moreover, ETH staking will also boost the entire decentralized finance (DeFi) space. The size and reliability of the Ethereum network make it roughly equivalent to the US Treasury bond market in the crypto world.

ETH staking has become the de-facto “risk-free” rate for cryptocurrencies and serves as the base rate against which all kinds of revenue-generating DeFi projects can be benchmarked.

The Ethereum Merge and future Ethereum upgrades, coupled with the development of a Layer 2 blockchain that allows for massive scaling while inheriting the security guarantees of the base layer, will create a new proof-of-stake-based infrastructure built on Ethereum. As a result, it leads to a sharp increase in the users rushing into the DeFi system.

Based on the combination of all these factors, it’s no wonder many are bullish on Ethereum, its ecosystem, and DeFi. This Merge was about long-term value, not short-term price appreciation. The Ethereum ecosystem is built over time. Despite current geopolitical and macroeconomic factors and recent market volatility, the community continues to develop innovative products and systems, and institutions desire institutions to participate.

Financial institutions and investment banks such as Goldman Sachs and Barclays, A16z, hedge funds such as Citadel Securities and Point72 Ventures, and retail banks such as Banco Santander and Itau Unibanco — invest their funds in cryptocurrencies and offer their clients cryptocurrency investment opportunities through Defi are now working on plans to provide options to their users.

As the bear market continues to build, it is believed that the future of DeFi for retail and institutional investors is bright.

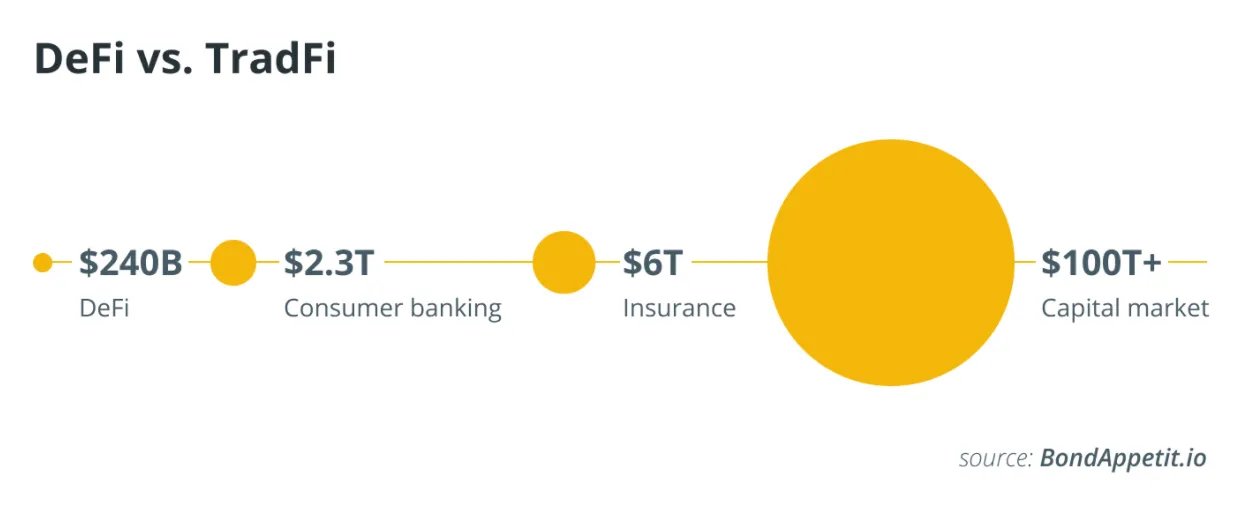

For a long time, the debate revolved around institutional investment in crypto rather than traditional finance (TradFi) vs. DeFi. The growing popularity of DeFi is often seen as the death knell for TradFi. However, the digital asset management strategies of many TradFi companies during the recession show that TradFi and DeFi have complemented each other. This trend will likely increase post-merge as institutional investors perceive it’s all a long game.

As the Merge will make the Ethereum network more secure and set it up for future scalability, it is expected that the institutions will become increasingly interested in engaging with the DeFi ecosystem.

Over the past two years, DeFi innovation has created the infrastructure and tools necessary for the institutional adoption of DeFi. As a result, more and more institution-focused projects are hitting the market, from approved credit pools that only guarantee KYC participants, to on-chain asset management, to MEV-resistant best execution protocols, to decentralized identities.

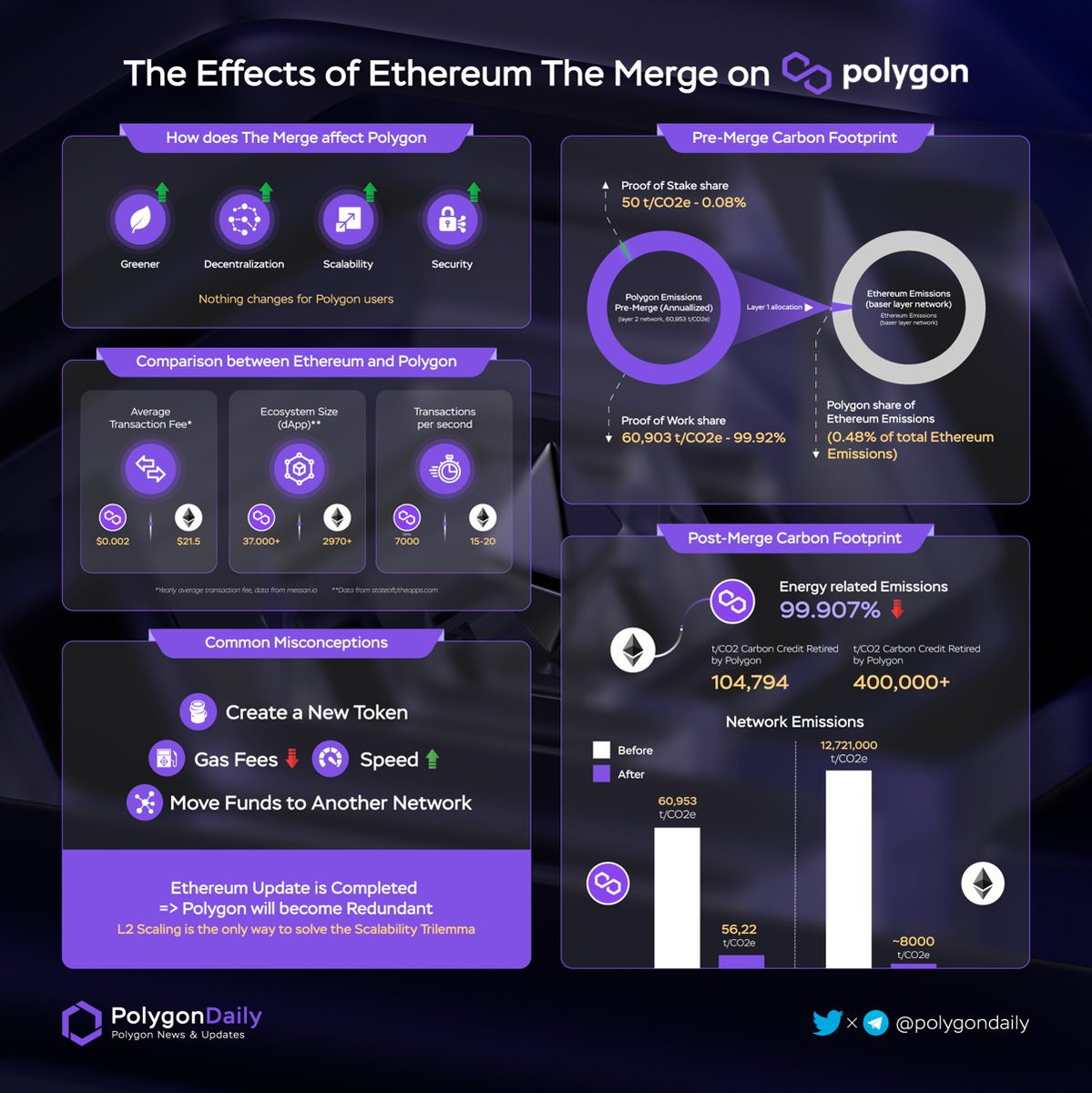

It can also be seen that the Layer -2 projects such as Optimism, Polygon, and Arbitrum are achieving enough of the DeFi volume for yield farming. Further, more institution-focused projects will hit the market as post-merge Layer 2 scaling accelerates.

It is a common misconception that Ethereum scaling solutions will eventually make Layer 2 solutions redundant, but most Layer 2 solutions, like Polygon, said that even if the Ethereum consensus changes, it does not reduce the need for a scaling solution.

The ETH Merge paves the way for sharding, but this upgrade is not enough to scale Ethereum. Nevertheless, the Polygon will benefit from it and improve the performance of scaling solutions. This Merge is expected to make Layer 2 more environment-friendly. Polygon claims it will reduce carbon emissions by 60,000 tons, or 99.91% of its current value.

Built to help Ethereum scale, Layer 2 will move along with the Ethereum Merge. So, for example, if Arbitrum is faster than Ethereum before the Merge and the Layer 1 itself becomes faster, then Arbitrum essentially scales in speed as well. As a result, user and developer experience with Layer 2s will improve in tandem with how Ethereum improves over time.

Both optimistic and zero-knowledge rollups will benefit greatly from sharding after the Merge, even in its most primitive form, which is only useful for storing data with guaranteed availability.

While rollups are likely to become more prevalent, sidechains will likely fall out of favor and lose popularity to the more scalable Layer 1 enabled by other rollups and the Merge.

Many industry insiders have hinted that no matter how scalable the network becomes, Layer 2 will continue to thrive and be able to gain a foothold on the Ethereum blockchain. After all the phases are completed on the Ethereum mainnet, L2s will continue to be the execution layer.

Opportunities after the ETH Merge

The move to PoS has created attractive reward opportunities for institutions. For example, the 4.06% annual returns on ETH positions as major ETH holders, including crypto exchanges, funds, and custodians, have already realized that holding ETH gives them a strong position within the DeFi ecosystem.

For Institutions, the DeFi opportunities are enormous, and mergers will only help the market mature and create opportunities for investors seeking returns in a riskier space. In addition, institutional investors who may have previously been skeptical of DeFi’s investment opportunities have found the growth of the DeFi-powered Web3 and other related financial products inevitable. They may still need to understand the dynamics behind DeFi or Web3 fully, but they have learned that digital asset classes must be addressed.

The DeFi ecosystem will change forever when people who stake ETH on the Beacon chain start receiving staking rewards. The search for the ETH killer coin has forced the Ethereum Foundation to take this step of the Merge.

Building dApps using smart contract applications have revolutionized the cryptocurrency industry, and mining ETH has made many fortunes. This new generation of dApps deployed on Beacon Chain contracts makes it easier for developers to deploy the APIs. The boom in new DeFi projects is based on Ethereum, the second-largest crypto asset by market capitalization.

When you invest your ETH into a staking pool, your stored ETH instantly becomes a time deposit, with estimated returns of up to 10%. The cryptocurrency community hopes this will attract more people to ETH, further boosting Web 3.0 and DeFi adoption.

Conclusion

Ethereum’s Proof of Stake integration has the potential to transform the network and establish Ethereum for long-term sustainability and scalability. Given the significant role Ethereum plays in both DeFi and NFTs, this should benefit the entire crypto ecosystem.

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter : https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

Facebook :https://www.facebook.com/brufinance/

Instagram :https://www.instagram.com/brufinance/?igshid=YmMyMTA2M2Y%3D

On-chain Protocol for Assets Tokenisation & Finance

1.png)