Asset Tokenization: Unlocking a $10 Trillion Market in Global Finance

Published On : October 19, 2024

Asset tokenization is no longer a futuristic concept — it’s a thriving reality today, offering immense opportunities for those ready to seize them.

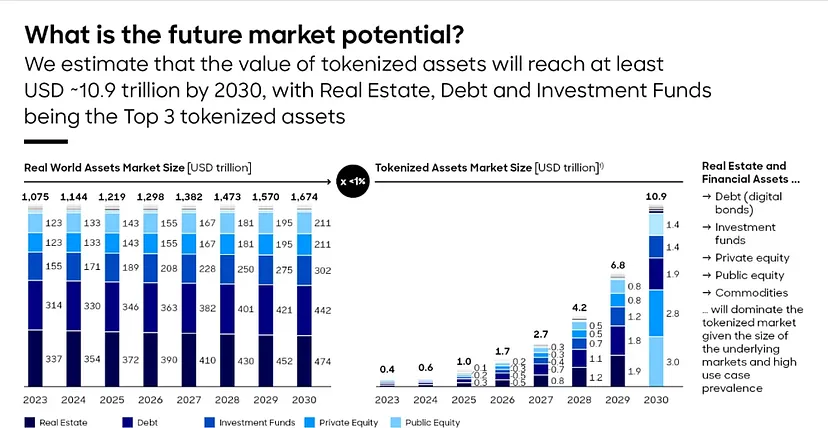

As the data shows, the asset tokenization market has skyrocketed, with projections estimating its value to exceed USD 10 trillion by 2030.

This surge underscores the growing acceptance of a new way of buying and selling assets, revealing the profound impact tokenization is poised to have on the future of finance.

Read more: Real-world examples of how businesses are using tokenization 3 Key Reasons Why Tokenization is the Future

Here are three main reasons why tokenization is transforming the investment landscape:

1. Lowering Investment BarriersTokenization allows the fragmentation of high-value assets into smaller, more affordable units, dramatically lowering the barriers to entry for individual investors. Assets like real estate, art, and venture capital funds, which were previously only accessible to high-net-worth or institutional investors, are now within reach of a broader audience.

For instance, with as little as $100, an individual can own a portion of a million-dollar property in a prime location and benefit from its appreciation.

2. Global Accessibility and Enhanced LiquidityBy leveraging blockchain, tokenization transcends geographic boundaries, enabling seamless cross-border investments. Furthermore, the divisibility of tokenized assets makes them significantly more liquid than traditional investments. Investors can buy or sell fractions of these assets more easily, speeding up transactions and offering more frequent liquidity. This makes tokenized assets highly appealing for those looking to convert investments into cash quickly.

3. Diversification OpportunitiesAccording to Bain & Company, tokenization opens up a $400 billion market for alternative investments. Investors can now diversify their portfolios by acquiring tokens across various asset classes such as venture capital, real estate, commodities, cryptocurrencies, and collectibles. This diversification spreads risk and enhances potential returns.

Blockchain Efficiency and Transparency- Decentralization: Blockchain’s decentralized nature eliminates the need for a central authority, reducing the risk of fraud and manipulation.

- Immutability: Transactions recorded on the blockchain cannot be altered or erased, guaranteeing data integrity and ensuring trust in the ownership and transfer of tokenized assets.

- Transparency: Blockchain’s transparency allows all participants to view and verify transaction histories, fostering accountability.

- Smart Contracts: Smart contracts automate processes, removing the need for intermediaries and reducing transaction costs.

- Reduced Intermediaries: Peer-to-peer transactions powered by blockchain cut out traditional intermediaries like banks, speeding up and simplifying the process.

- Access to Global Assets: Blockchain-based public platforms enable global access to tokenized assets without requiring a bank or brokerage account, democratizing investments for everyone.

- Lower Costs and Complexity: Tokenization simplifies cross-border transactions, significantly cutting down on fees and complexity. Nasdaq suggests that bond issuance costs could drop by 80% through tokenization, while Roland Berger estimates total savings of 4.6 billion Euros by 2030.

- Faster Transactions: Tokenization speeds up trading with 24/7 availability and smart contracts automating trades based on set criteria, reducing settlement time and minimizing risk.

- Streamlined Currency Exchange and Compliance: Tokenization facilitates easy asset conversions using cryptocurrencies or stablecoins and ensures compliance with international regulations like AML and KYC, providing investors with a secure and transparent investment process.

Tokenization is unlocking new investment opportunities beyond traditional assets like real estate, art, and securities. Asset tokenization platforms are simplifying and streamlining the process, enabling businesses and investors to tokenize and manage a broader range of assets with ease. As a result, investors now have access to tokenized ownership of intellectual property, commodities, and other assets that were once difficult to trade.

Here’s a summary of what the future of tokenization holds:

Expanding Investment Opportunities:Tokenization is broadening access to non-traditional assets, allowing investors to easily acquire tokenized ownership in areas such as intellectual property, commodities, and other previously hard-to-trade assets.

Global Accessibility:Blockchain technology is making tokenized assets more accessible on a global scale. Investors from anywhere in the world can now participate in a wider range of investment opportunities, helping to democratize finance and create a more inclusive financial landscape.

Regulatory Clarity:The future will likely bring clearer regulatory frameworks around tokenized assets. As governments and regulators establish more defined guidelines, institutional investors will gain confidence, leading to increased participation and growth in the market.

Enhanced Interoperability:Standardized protocols across different blockchain networks will improve the exchange and interaction of tokenized assets. This enhanced interoperability will create a more connected ecosystem, enabling smoother transactions and fostering greater market efficiency.

Bru FinanceBru Finance exemplify the real-world applications of tokenomics in the commodities market. Through tokenized bonds, they are pioneering the democratization of commodity investments, unlocking new avenues for investors and reshaping the way traditional assets are managed and traded.

The allure of commodities-backed bonds continues to grow across diverse categories of investors, from individuals to institutional players. The diversity of commodities available for backing, coupled with the promise of stable returns, makes these bonds a valuable addition to investment portfolios.

Decentralized finance takes the concept of commodity-backed bonds to the next level by tokenizing commodities and issuing bonds on blockchain networks. This approach introduces enhanced transparency, liquidity, and accessibility compared to traditional models.

In the DeFi space, platforms like Bru.Finance issues fractional commodity-backed bonds backed by real-world agricultural commodities at over 140% collateralization. Liquidity providers can subscribe to these 6-month bonds to earn yields.

What sets Brú Finance apart is its unwavering commitment to the interests of farmers and small businesses, promoting sustainability and financial inclusion. Fractional ownership features render their commodity-backed bonds accessible to retail liquidity providers, further promoting financial inclusion and asset liquidity.

Moreover, the advent of blockchain technology and digital assets has streamlined the issuance and trading of commodities-backed bonds. Blockchain’s transparent and efficient tracking of the underlying commodities reduces the risk of fraud and ensures greater accountability

The major hurdle for RWA tokenization is the uncertain legal landscape. Converting assets like real estate or gold into tokens could classify them as securities, bringing regulatory challenges that dampen the benefits of utility tokens. There’s also the issue of verifying the authenticity of the assets backing these tokens. In a decentralized, trustless crypto world, users are naturally skeptical, making it harder to build trust in asset-backed tokens.

Yet, with sufficient government backing, especially in democratically legitimate jurisdictions, these challenges can be overcome. As crypto and finance become more intertwined, investors may feel more comfortable with government-backed tokenized assets.

But there’s a paradox at play. RWAs tend to be stable, making them less attractive to crypto traders who thrive on volatility. Low volatility leads to reduced trading activity and less liquidity, which in turn discourages traders and market makers. Without this self-reinforcing cycle of liquidity, the economic incentive to issue RWA tokens weakens.

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter : https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

Facebook :https://www.facebook.com/brufinance/

Instagram :https://www.instagram.com/brufinance/?igshid=YmMyMTA2M2Y%3D

1.png)