Brú Finance Redefines Commodity Investing: What Does the Future Hold?

Published On : October 26, 2024

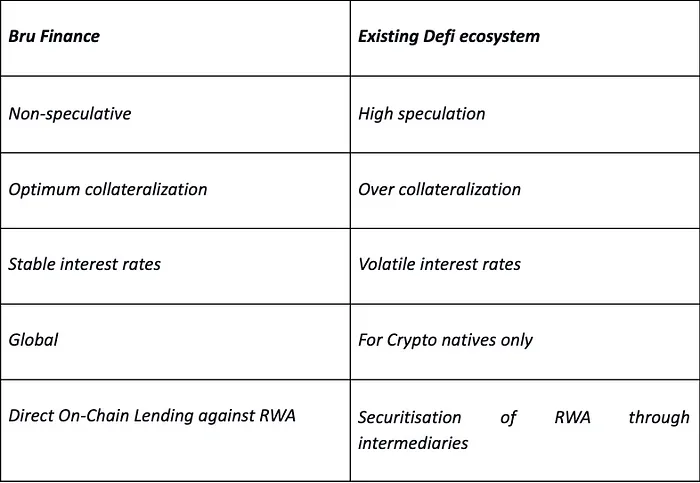

During the 2018–19 crypto winter, most financial institutions steered clear of direct involvement with cryptocurrencies. The volatility of tokens and an uncertain regulatory environment fostered a cautious approach. Fast forward to 2024, and the landscape has transformed. Tokenization is gaining significant momentum as governments and regulators begin to acknowledge the advantages of blockchain technology — such as enhanced liquidity, fractional ownership, and global access — without the full exposure to cryptocurrency volatility.

Governments worldwide are now revising their regulatory frameworks to tap into blockchain’s future potential. Real-world assets are set to play a key role in driving the next phase of digital asset adoption. Over the past year, major financial institutions have started exploring the tokenization of tangible assets like precious metals, art, and real estate, bringing ownership of these assets onto blockchain platforms. A report by Boston Consulting Group predicts that by 2030, asset tokenization could evolve into a multi-trillion-dollar market.

Tokenized real-world assets have emerged as a promising hedge against market volatility, offering investors stability and resilience. This renewed interest isn’t confined to private or closed systems; financial institutions are increasingly exploring tokenized financial instruments on public blockchains within institutional DeFi frameworks. This represents a significant shift from the hesitation that dominated just a few years ago and underscores a growing confidence in decentralized networks.

A recent Bank of America report affirms this trend, highlighting the tokenization of commodities, currencies, and equities as a “key driver of digital asset adoption.” Analysts see this as the early stages of an infrastructure revolution, with tokenization poised to reshape how industries transfer, settle, and store value.

Tokenization enhances both transparency and security within markets. Blockchain ensures that each transaction is immutable and transparent, offering a tamper-proof record of ownership and transaction history. This transparency helps reduce fraud and builds trust among market participants. Additionally, smart contracts embedded in tokenized assets automate compliance with regulatory requirements and streamline processes like settlement and dividend distributions, further strengthening market integrity.

Several success stories from the financial sector demonstrate the potential of tokenized assets, such as bonds and commodities. Companies like Brú Finance have been at the forefront of tokenizing commodity assets, providing stable income opportunities for DeFi liquidity providers while reshaping the Indian commodity finance landscape.

The appeal of commodities-backed bonds is growing among a diverse range of investors, from individuals to institutional players. The variety of commodities available for backing, coupled with the promise of stable returns, makes these bonds a valuable addition to investment portfolios.

Brú Finance stands out for its strong focus on supporting farmers and small businesses, promoting sustainability and financial inclusion. The fractional ownership model of its commodity-backed bonds makes them accessible to retail liquidity providers, enhancing both financial inclusion and asset liquidity. Blockchain technology has also streamlined the issuance and trading of these bonds, ensuring transparency and reducing the risk of fraud.

In the DeFi space, Brú Finance has taken commodity-backed bonds to the next level by issuing tokenized bonds on blockchain networks. This approach brings enhanced transparency, liquidity, and accessibility compared to traditional finance models. With over 140% collateralization, Brú Finance offers fractional commodity-backed bonds tied to real-world agricultural commodities, allowing liquidity providers to earn yields on 6-month bonds.

Here’s a quick guide to getting started on the Brú Finance platform:

1. Open the Brú Finance platform.

2. Click on “Buy Bonds” or “Borrow.”

3. Connect your Metamask Wallet.

4. Select the Polygon network.

5. Ensure your wallet has USDT tokens (you can use the platform’s faucet to get test USDT).

6. Click the preferred action — either buy or borrow bonds.

7. Enter the amount and confirm the transaction.

In a relatively short time, Brú Finance has already tokenized over $700 million worth of agricultural commodities and distributed over $14 million in loans to farmers across India. Their success and integrated platform position them to scale operations, with the Indian commodity finance market estimated to reach $30 billion by 2025. Brú Finance’s partnerships with government bodies, the World Bank, Mastercard, and other institutions further strengthen their foothold. They’ve secured a $150 million credit line for supply chain finance and are working with Mastercard to launch a tokenized commodity-backed credit card — a global first.

As Brú Finance expands beyond India into markets in Southeast Asia and Africa, it is poised to play a pivotal role in bringing decentralized finance to the global south’s commodity sectors. With plans to roll out asset-backed lending products such as Gold Loans, Machinery Finance, and Receivables Finance over the next 24 months, Brú Finance aims to be a leading player in the global DeFi space.

Brú Finance is also actively working on its token generation event (TGE) and integrating Web3 capabilities like NFTs and decentralized identity into its platform. These innovations will enhance the user experience and open up new business models, positioning the company as a key innovator in the evolving blockchain and DeFi landscape.

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter : https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

Facebook :https://www.facebook.com/brufinance/

Instagram :https://www.instagram.com/brufinance/?igshid=YmMyMTA2M2Y%3D

On-chain Protocol for Assets Tokenisation & Finance

1.png)