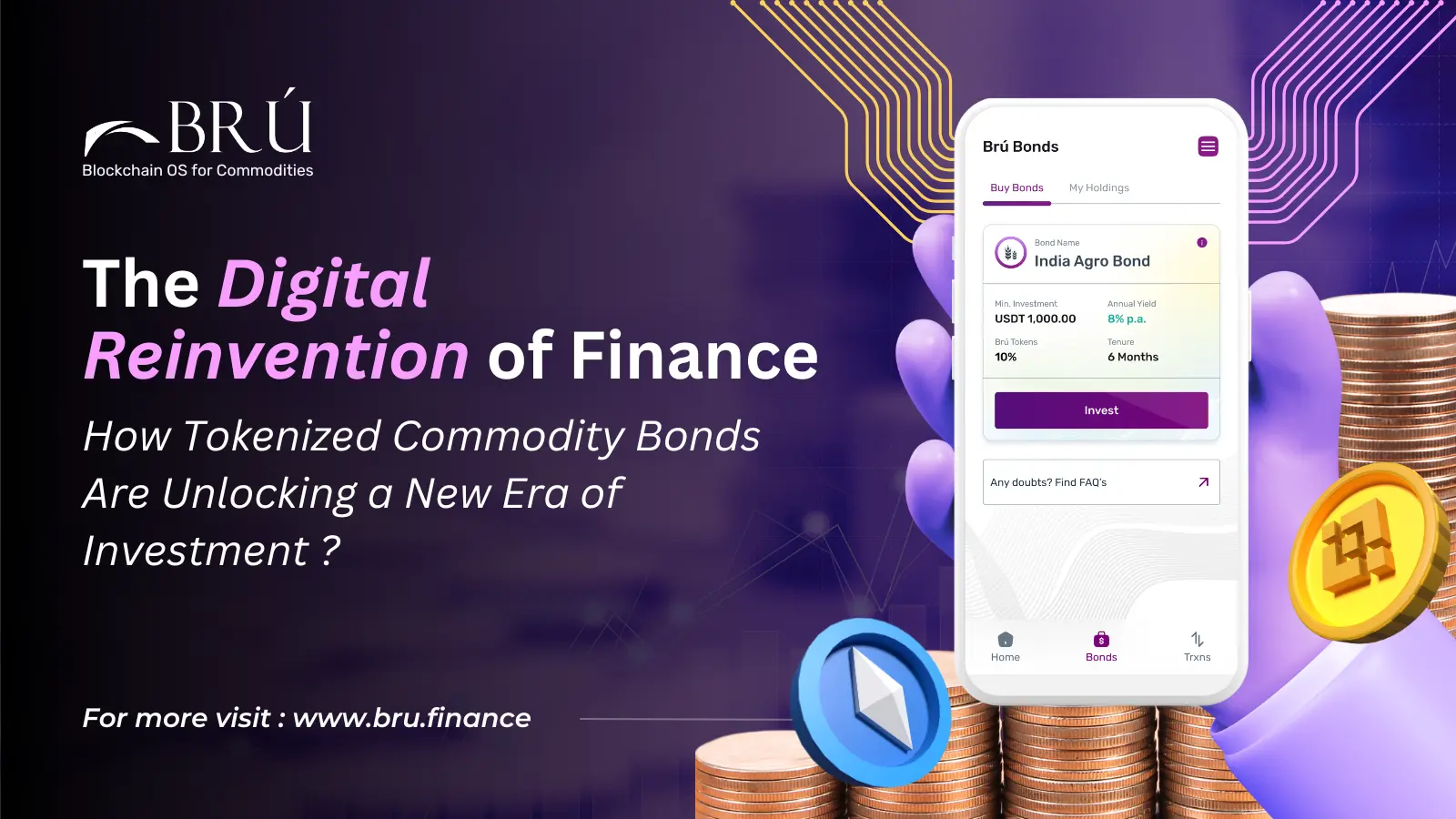

The Digital Reinvention of Finance: How Tokenized Commodity Bonds Are Unlocking a New Era of Investment ?

Published On : January 31, 2025

The financial world is in the midst of a seismic shift. Traditional instruments are colliding with cutting-edge technology, creating opportunities that were once unimaginable. At the forefront of this transformation is the tokenization of commodity-backed bonds—a process that leverages blockchain technology to digitize ownership of bonds tied to physical commodities like gold, oil, and agricultural products.

This innovation is not just a buzzword; it’s revolutionizing the bond market by enhancing liquidity, transparency, and accessibility.

But what exactly does this mean, and why should you care?

Let’s dive in.

What Are Commodity-Backed Bonds?

Commodity-backed bonds are debt securities collateralized by physical assets. Think gold bars, barrels of oil, or even bushels of wheat. These bonds offer investors a hedge against inflation and commodity price volatility, making them an attractive option for those seeking stable returns. However, the traditional process of issuing and trading these bonds has been far from efficient. It’s often bogged down by paperwork, intermediaries, and regulatory complexities. Enter tokenization—a game-changer that’s streamlining the entire process.

What is Tokenization?

Tokenization is the process of creating digital tokens that represent ownership of an asset, recorded securely on a blockchain. In the context of commodity-backed bonds, these tokens represent fractions of the bond’s value, each backed by a physical commodity. This digital transformation brings a host of benefits that are reshaping the financial landscape.

Benefits of Tokenizing Commodity-Backed Bonds

- Enhanced Liquidity -Tokenization allows for fractional ownership, meaning investors can buy and sell small portions of a bond rather than the entire security. This opens the door for more participants, significantly boosting market liquidity.

- Increased Transparency -Blockchain’s immutable ledger ensures that every transaction is recorded transparently and cannot be altered. This reduces the risk of fraud and builds trust among investors, as all activity is publicly verifiable.

- Cost Efficiency - By cutting out intermediaries and automating processes through smart contracts, tokenization slashes administrative costs and speeds up settlement times. It’s a win-win for both issuers and investors.

- Broader Accessibility -Tokenized bonds can be traded 24/7 on digital exchanges, giving global investors unprecedented access. This democratizes investment opportunities, creating a more inclusive financial ecosystem.

While the benefits are compelling, there are challenges to consider:

- Regulatory Compliance - Different jurisdictions have varying regulations for digital assets. Issuers and investors must ensure compliance with local securities laws to avoid legal complications.

- Security and Custody -Protecting digital tokens from hacking and theft is paramount. Robust cybersecurity measures and secure custody solutions are essential.

- Market Adoption - For tokenized bonds to succeed, the market needs to embrace them. Education and awareness are key to helping investors and issuers understand the advantages of tokenization.

- Technological Infrastructure -A reliable and scalable infrastructure is necessary to support the issuance, trading, and settlement of tokenized bonds. This includes blockchain platforms, digital wallets, and exchanges.

Projects like Bru Finance is already leading the charge in this space.This innovative platform has tokenized agricultural commodities, issuing fractional bonds at over 140% collateralization. Their approach not only provides stable yields for investors but also promotes financial inclusion for farmers and small businesses. In the decentralized finance (DeFi) space, platforms like Bru Finance are taking commodity-backed bonds to the next level. By issuing bonds on blockchain networks, they’re introducing unprecedented levels of transparency, liquidity, and accessibility.

Why This Matters

The tokenization of commodity-backed bonds represents more than just a technological advancement—it’s a paradigm shift. By merging the stability of physical commodities with the efficiency of blockchain, this innovation is transforming how bonds are issued, traded, and managed.

For investors, it’s an opportunity to diversify portfolios with stable, accessible, and transparent assets. For issuers, it’s a chance to streamline processes and reach a global audience. And for the financial system as a whole, it’s a step toward a more inclusive and efficient future.

The Road Ahead

As the tokenization landscape continues to evolve, one thing is clear: the future of finance is digital. Whether you’re an investor, issuer, or simply a curious observer, understanding this emerging domain is key to unlocking its full potential.

So, are you ready to break free from traditional bonds and explore the digital goldmines of tomorrow? The revolution is here—don’t get left behind.

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter : https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

Facebook :https://www.facebook.com/brufinance/

Instagram :https://www.instagram.com/brufinance/?igshid=YmMyMTA2M2Y%3D

1.png)