Real-World Assets (RWAs): The Next Big Leap in Crypto

Published On : January 09, 2025

The term real-world assets (RWAs) has gained traction among crypto enthusiasts and institutions, referring to on-chain representations of ownership in traditional assets such as real estate, debt, equity, fund LP units, and more.

A Breakout Year for RWAs in 2024

The year 2024 saw a surge in RWA tokenization, driven by several key milestones:

- BlackRock’s Moves: The firm tokenized one of its funds and invested in a tokenization-focused company.

- Banking Evolution: Banks and asset managers progressed from proofs of concept to real-world implementations.

- Licensing Milestones: New licenses, including 21X under the DLT Pilot Regime, Ursus-3 Capital as the first ERIR in Spain, and Nomura’s Laser Digital license in Abu Dhabi Global Market (ADGM), fueled adoption.

Crypto enthusiasts are increasingly recognizing the value of tokenized real-world assets, making RWAs one of the most lucrative narratives in the space.

What Lies Ahead in 2025?

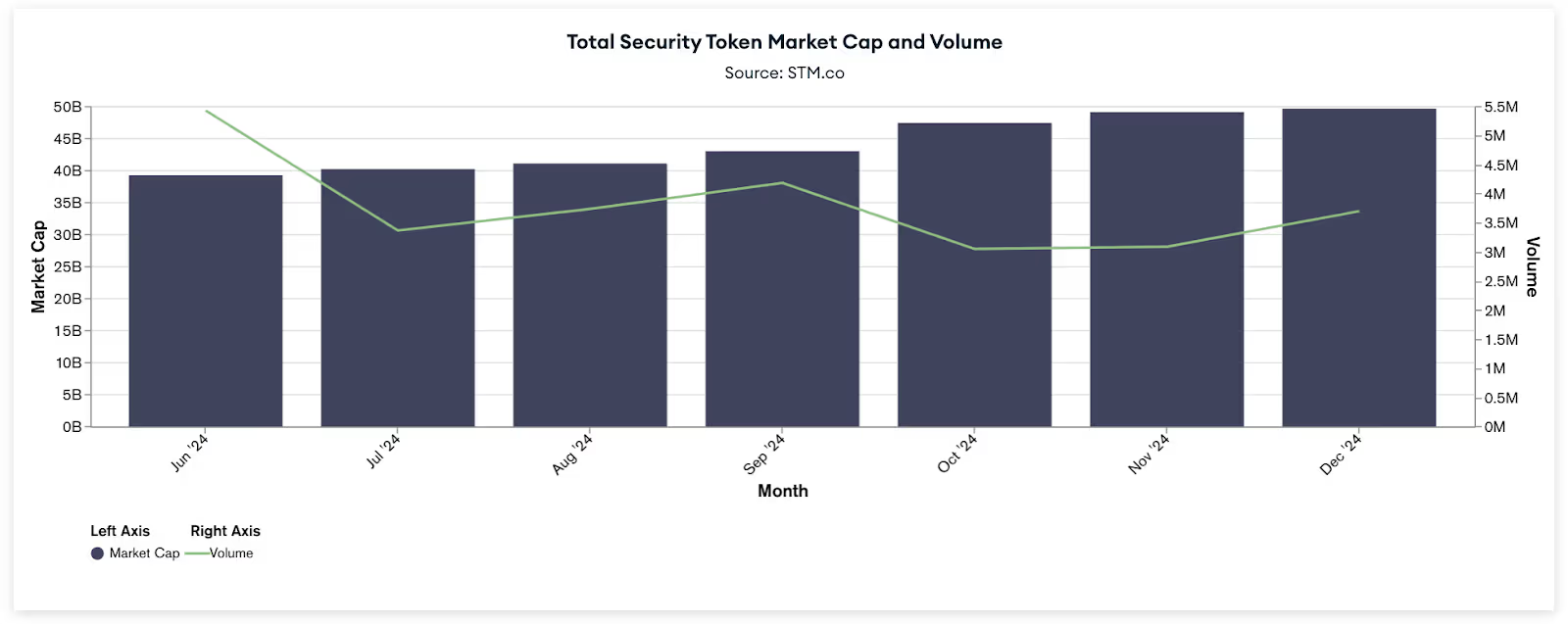

In 2025, tokenization is expected to cement itself in the mainstream, transitioning to the "pragmatists" phase of the adoption curve. With over $50 billion in RWAs already on-chain, projections suggest the market could exceed $500 billion in value by year-end (excluding stablecoins).

Market Drivers

- Collateral Mobility: Assets like stablecoins, yield-generating tokens, and tokenized liquidity products will attract more investors.

- Streamlined Operations: Proven efficiencies and cost savings will drive preference for tokenized assets over their traditional counterparts.

- Real Estate Innovation: Real estate alone could account for over $30 billion in tokenized value through mechanisms like HELOCs, collateralized loans, on-chain titles, and alternative financing models.

Regulatory Clarity: The Key to Unlocking Potential

Regulatory uncertainty remains a major barrier to widespread adoption. However, significant progress may be on the horizon. The appointments of Paul Atkins as SEC chair, Perianne Boring at the CFTC, and David Sacks as Crypto Czar are increasing optimism for a clear U.S. legal framework.

Countries like the EU, Switzerland, and Singapore have demonstrated that robust regulation, including sandbox initiatives, can accelerate global momentum. Clearer rules could encourage greater institutional participation, boost investor confidence, and foster innovation in RWA infrastructure.

Bridging Crypto and Traditional Finance

Institutional interest in tokenization stems from operational efficiencies and cost savings. Meanwhile, the crypto community is leveraging governance and utility tokens to offer holders benefits like discounted trading fees, priority deal access, and decision-making influence. This approach resonates with crypto-native participants, redirecting gains from crypto and NFTs toward RWAs while incentivizing the development of dApps and supporting infrastructure. Potential U.S. tax breaks on gains from domestically issued utility or governance tokens could further enhance this trend.

The Year of Convergence

As tokenization gains traction, 2025 will mark a pivotal year for financial asset tokenization, both as a concept and an applied solution. Institutional adoption will produce tangible results, sparking confidence to explore even riskier tokenization endeavors. Integration with DeFi ecosystems will propel both primary and secondary markets by enhancing utility and unlocking new economic opportunities.

The gap between crypto-native communities and traditional finance is narrowing. Tokenization is no longer a vision of the future—it’s happening now and will only grow. If you’re not already paying attention, 2025 is the year to start. With regulatory clarity, institutional adoption, and enhanced utility leading the charge, exponential growth is just around the corner.

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter : https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

Facebook :https://www.facebook.com/brufinance/

Instagram :https://www.instagram.com/brufinance/?igshid=YmMyMTA2M2Y%3D

1.png)