A brief history of real-world assets — Why do they matter?

Published On : January 02, 2025

Real-world asset (RWA) tokenization is an emerging concept that traces back to the advent of blockchain technology. The journey began with Bitcoin’s introduction in 2009, which unveiled a decentralized, secure, and transparent ledger system.

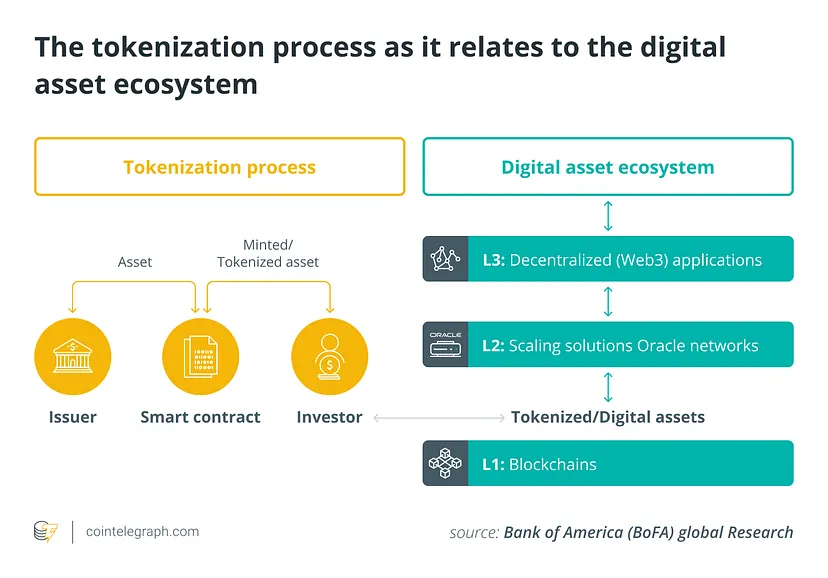

This groundbreaking technology laid the foundation for turning physical assets into digital tokens recorded on a blockchain. However, the real leap forward came with Ethereum in 2015, introducing smart contracts — self-executing agreements coded directly onto the blockchain.

With smart contracts, it became possible to digitally represent physical assets like real estate, art, and commodities, bridging the gap between the physical and digital worlds. The potential for this technology to impact global economies and social structures quickly became apparent.

Why do RWAs matter?

To understand the significance of RWA tokenization, picture a large pizza you want to share with friends. Instead of giving each friend the whole pizza, you slice it into pieces, with each slice representing part of the whole.

Tokenization works similarly with assets. When an asset is tokenized, it’s divided into smaller parts called “tokens,” each representing a share of the asset. These tokens can represent anything valuable, from real estate to intellectual property. Managed and traded using blockchain technology, these tokens ensure secure and transparent ownership records, making assets more accessible, liquid, and tradable globally.

The impact of tokenization

Consider the real estate market in cities like New York or London. A $10 million property could be divided into 10 million tokens at $1 each. This enables individuals to invest as little as $100, owning a slice of high-value real estate.

Tokenization brings liquidity to the real estate market, which is traditionally illiquid and difficult for smaller investors to access. According to MarketsandMarkets, the global real estate tokenization market is projected to reach $1.4 trillion by 2026, growing at a CAGR of 22.8%.

The same principle applies to commodities. An ounce of gold worth $2,000 can be tokenized into 2,000 shares at $1 each. This lowers the barrier to entry, allowing more investors to gain exposure to commodities without needing significant capital. Grand View Research forecasts the tokenized commodities market to reach $4.5 billion by 2025.

Tokenization also empowers creators to monetize their intellectual property. A patent valued at $1 million could be divided into 1 million tokens at $1 each. Investors can purchase these tokens and share in the revenue generated, rewarding creators while opening up investment opportunities to a broader audience. Juniper Research predicts the market for tokenized intellectual property rights will reach $320 million by 2025.

Even private equity and venture capital, traditionally reserved for the wealthy, can be democratized through tokenization. A $100 million venture capital fund could be divided into 100 million tokens at $1 each, enabling smaller investors to participate in early-stage investment opportunities previously out of reach. The Boston Consulting Group projects tokenized private equity markets to reach $1.7 trillion by 2030.

The social aspect of RWA tokenization

Beyond economic gains, RWA tokenization has profound social implications, particularly in advancing financial inclusion. In many parts of the world, access to traditional financial markets is limited by geography, income, and infrastructure. Tokenization can bridge these gaps, enabling people from all economic backgrounds to participate in wealth creation using just a smartphone and an internet connection.

In developing economies where banking infrastructure is lacking, this empowerment can help millions build wealth and improve their economic standing. It can lead to broader societal benefits like reduced poverty and increased access to education and healthcare. By democratizing investment opportunities, tokenization fosters a more inclusive and equitable global economy.

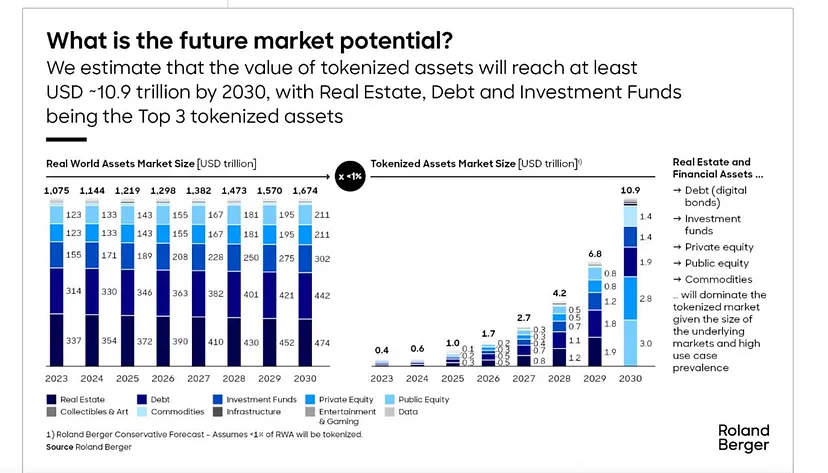

The numbers speak volumes. The World Economic Forum estimates that by 2030, the tokenized real-world assets market could reach $16.1 trillion, accounting for about 10% of global GDP.

Why is RWA tokenization essential to make a social and economic impact?

The potential of real-world asset tokenization to transform global finance is immense. From real estate and art to commodities and intellectual property, tokenization enables individuals from diverse economic backgrounds to participate in wealth creation and asset appreciation.

Adoption of RWAs can and will reduce economic disparities, offering financial inclusion to the unbanked and underserved. Legally, it challenges traditional ownership structures, potentially leading to more equitable property rights. Politically, it may shift power dynamics by distributing economic influence more widely. Economically, it can stimulate growth in emerging markets by unlocking local asset value and attracting global investment.

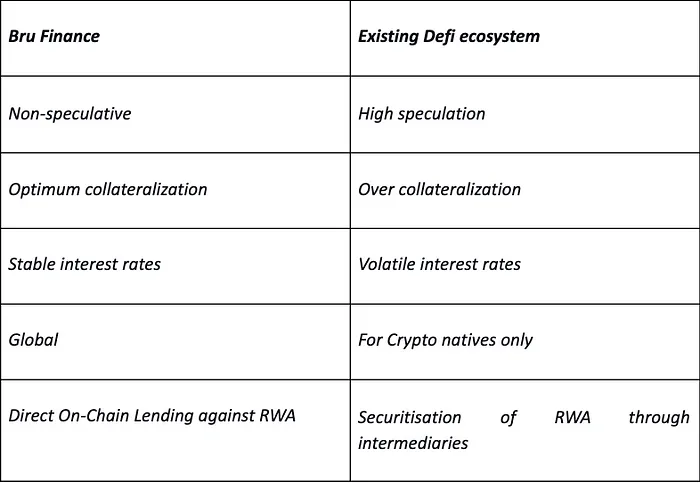

Brú Finance stands out for its strong focus on supporting farmers and small businesses, promoting sustainability and financial inclusion. The fractional ownership model of its commodity-backed bonds makes them accessible to retail liquidity providers, enhancing both financial inclusion and asset liquidity. Blockchain technology has also streamlined the issuance and trading of these bonds, ensuring transparency and reducing the risk of fraud.

In the DeFi space, Brú Finance has taken commodity-backed bonds to the next level by issuing tokenized bonds on blockchain networks. This approach brings enhanced transparency, liquidity, and accessibility compared to traditional finance models. With over 140% collateralization, Brú Finance offers fractional commodity-backed bonds tied to real-world agricultural commodities, allowing liquidity providers to earn yields on 6-month bonds.

Here’s a quick guide to getting started on the Brú Finance platform:

- Open the Brú Finance platform.

- Click on “Buy Bonds” or “Borrow.”

- Connect your Metamask Wallet.

- Select the Polygon network.

- Ensure your wallet has USDT tokens (you can use the platform’s faucet to get test USDT).

- Click the preferred action — either buy or borrow bonds.

- Enter the amount and confirm the transaction.

In a relatively short time, Brú Finance has already tokenized over $700 million worth of agricultural commodities and distributed over $14 million in loans to farmers across India. Their success and integrated platform position them to scale operations, with the Indian commodity finance market estimated to reach $30 billion by 2025. Brú Finance’s partnerships with government bodies, the World Bank, Mastercard, and other institutions further strengthen their foothold. They’ve secured a $150 million credit line for supply chain finance and are working with Mastercard to launch a tokenized commodity-backed credit card — a global first.

As Brú Finance expands beyond India into markets in Southeast Asia and Africa, it is poised to play a pivotal role in bringing decentralized finance to the global south’s commodity sectors. With plans to roll out asset-backed lending products such as Gold Loans, Machinery Finance, and Receivables Finance over the next 24 months, Brú Finance aims to be a leading player in the global DeFi space.

Brú Finance is also actively working on its token generation event (TGE) and integrating Web3 capabilities like NFTs and decentralized identity into its platform. These innovations will enhance the user experience and open up new business models, positioning the company as a key innovator in the evolving blockchain and DeFi landscape.

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter : https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

Facebook :https://www.facebook.com/brufinance/

Instagram :https://www.instagram.com/brufinance/?igshid=YmMyMTA2M2Y%3D

1.png)